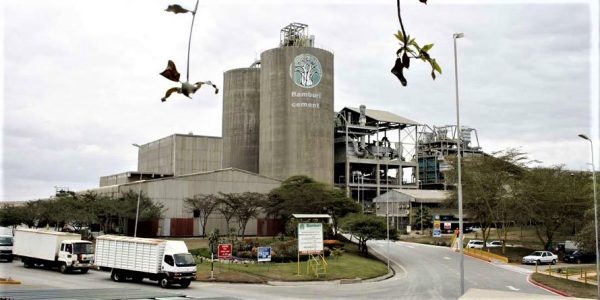

BAMBURI PREDICTS FURTHER DROP IN CEMENT DEMAND

Bamburi Cement expects demand for cement to remain muted for the remainder of 2019 due to slow down in government projects and credit squeeze.

Managing Director Seddiq Hassani said there has not been much recovery in demand so far as had been expected, meaning annual consumption could fall for the third straight year from the peak of 6.3 million metric tonnes of 2016.

“We were expecting to recover but the market has been flat. In 2019, we see a flat or slight decline of 2% meaning the market will be below 5.8 million metric tonnes,” he told the Business Daily.

Hassani linked the decline in consumption on reduced infrastructure activity due to rising debt as well as a drop in real estate projects as borrowers struggle to access loans.

“We have seen some government projects get cancelled, postponed or scaled down. This has also had a psychological impact on individual home projects compounded with limited credit,” explained Mr Hassani.

This has been worsened by declining cement prices as the industry tries to woo new customers in an environment of rising electricity and fuel costs.

Cement production decreased by 2.4% while consumption grew marginally by 0.18% in the half-year of 2019, according to the Kenya National Bureau of Statistics.

Kenya’s cement manufacturers Bamburi, recently acquired ARM Cement, Mombasa Cement, East African Portland Cement, Savannah Cement and National Cement — have been increasing their capacity despite falling consumption.

Total capacity stands at 13.2 million metric tonnes but production in 2018 was 6.07 million metric tonnes, being utilisation rate of 46%. This contrasts with a utilisation rate of 69 % in 2016.https://www.businessdailyafrica.com/corporate/companies/Bamburi-predicts-further-drop-in-cement-demand/4003102-5319472-kaa18d/index.html